owe state taxes payment plan

Have not defaulted on previous payment plans for personal income taxes. 103 declaring both a Public Health Emergency PHE and a State of Emergency.

How To File For A Tax Extension Ramsey

Pay personal income tax owed with your return.

. Balance Owed Payment Terms. PROPERTY TAX DUE DATES. You can also review and manage your payment plan online.

In Person - The Tax Collectors. 2484 West 1st Street Brooklyn NY 11223 Tel. If you do not know your payment agreement.

If you owe tax or other debt to the Minnesota Department of Revenue and cannot pay in full you may request to make installment payments. Pay income tax through Online Services regardless of how you file your return. If you cant pay your tax bill in 90 days and want to get on a payment plan you can apply for an installment agreement.

If you owe 100000 in back taxes but have only an ability to pay 20000 then the IRS may forgive the remaining amount of your back taxes. Customers who wish to incorporate a new liability into. The Department of Revenue will always attempt to work with you in order to pay your debt but you must contact us.

Or if you prefer you can complete the. Dont ignore your debt. If including payment of taxes owed when mailing your Indiana income tax return print your SSN and tax year on the check or money order.

Up to 36 months. Up to 12 months. You can pay or schedule a payment for any day up to.

The department may file a Notice of. With the State of Maryland recurring direct debit program you dont have to worry about mailing off a check for your individual tax payment plan. Balance Owed1000 to 4999.

Balance Owed0 to 999. It may take up to 60 days to process your request. Call us at 503 945-8200 to discuss your debt and options.

Please be aware of the following when asking for a payment plan. File your tax return anyway to avoid penalties. Income Tax Self-Service Back New Developments for Tax Year 2021 Back Income Tax Self-Service.

Irene Kostetsky EA CEP Tax Management Inc. HOW TO PAY PROPERTY TAXES. To obtain a six-month payment plan you can use the CD-6 Web Application.

After 60 days a 25 cost of collection fee will be added to your Notice of Tax Due. On March 9 2020 Governor Murphy issued Executive Order No. Payment Terms12 months or less.

Up to 24 months. If you owe 100000 and have a. Payment Plans for Qualified Applicants.

Pay what you can by the due date of the return. What you should know about payment plans. Mail in your payment.

Pay through Direct Debit automatic monthly payments from your checking account also known as a Direct Debit Installment Agreement DDIA. You can request a payment plan for any unpaid amount including Cigarette Taxes Homestead Benefit and Senior Freeze Property Tax. If you owe a tax debt to the Georgia Department of Revenue and cannot afford to pay it all at once you can request an installment payment agreement to settle your.

Call our Collections Department at 8043678045 during regular business hours to speak with a representative.

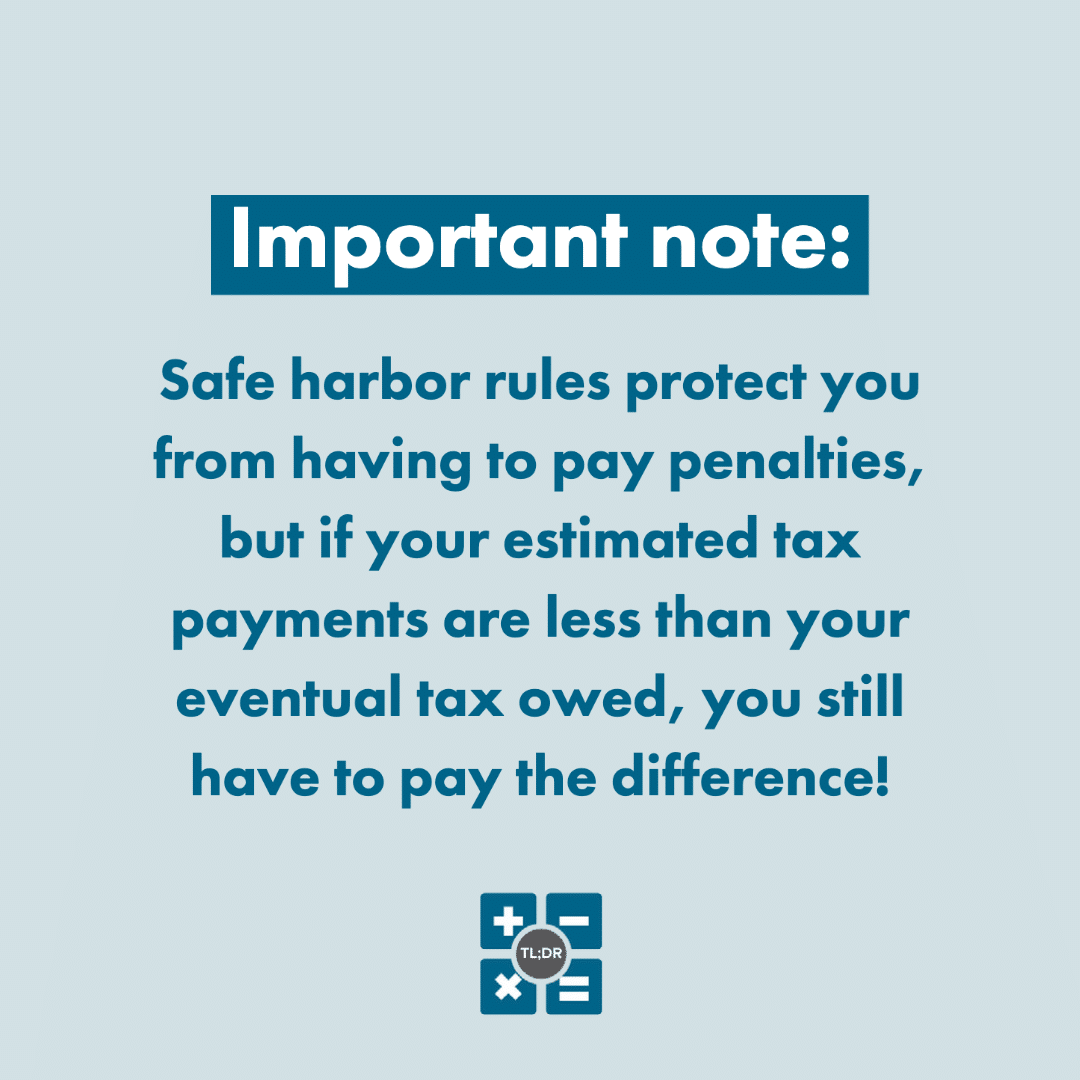

Paying 2022 Tax Estimates Tl Dr Accounting

Can I Pay Taxes In Installments

Federal And State Payments Electronic Funds Withdrawal Setup

Irs Payment Plan Everything You Need To Know Community Tax

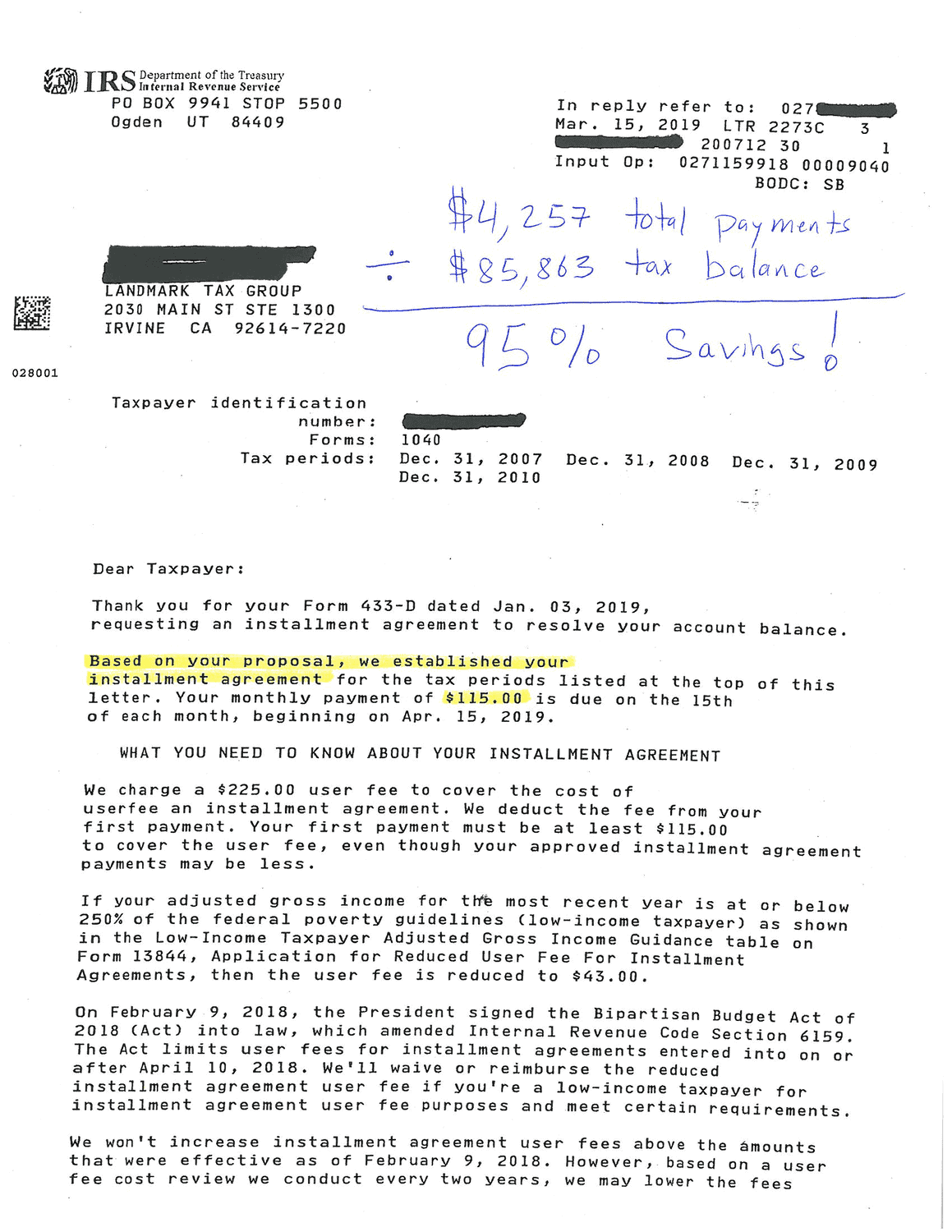

How An 85 863 Irs Bill Reached A 95 Settlement Landmark Tax Group

Estimated Tax Payment Due Dates For 2022 Kiplinger

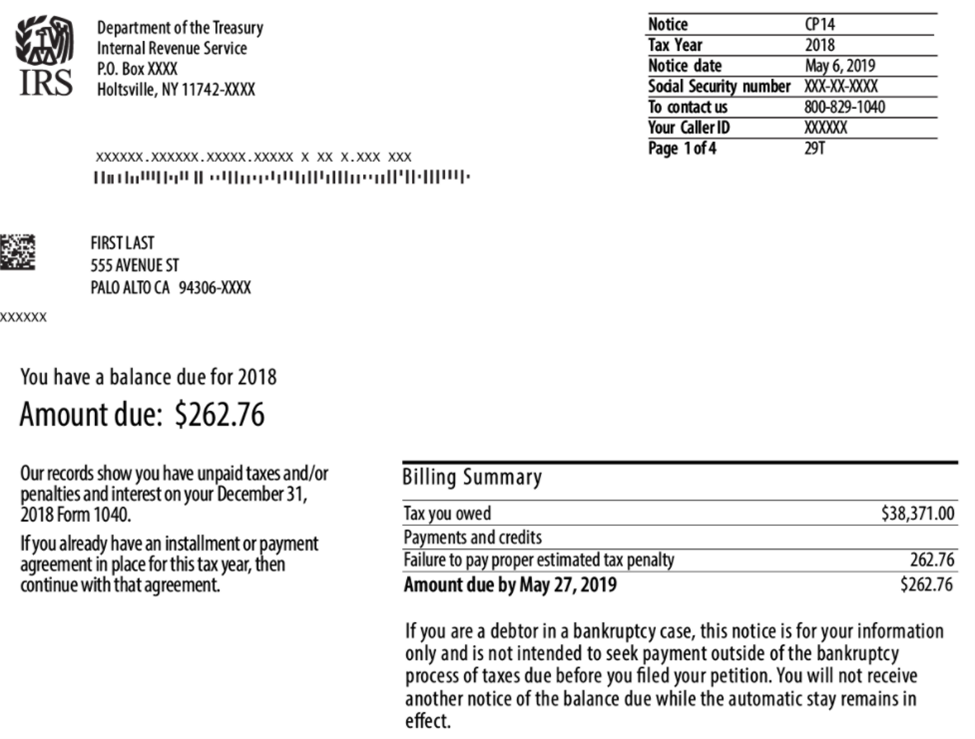

The Irs Is Sending Millions Of Tax Payment Letters This Month Don T Ignore Them Cbs News

How Are Dividends Taxed 2022 Dividend Tax Rates The Motley Fool

Dor Owe State Taxes Here Are Your Payment Options

How Long Do You Really Have To Respond To An Irs Tax Due Notice The Wolf Group

Irs Payment Plan How It Works Tax Relief Center

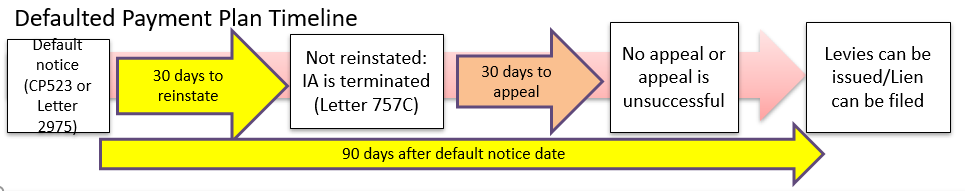

What Should I Do If I Defaulted On My Irs Payment Plan Irs Mind

What Is The Interest Rate On Installment Agreements

Irs No Penalty For Filing Taxes Late If You Re Getting A Refund

Irs Payment Plan Installment Agreement Options Nerdwallet

How To Pay Your Taxes With A Credit Card In 2022 Forbes Advisor